The MyMilestoneCard member portal homepage serves as your personalized gateway into a robust suite of helpful account management features – from reviewing balances to tracking investments to making payments. This article explores key capabilities accessible through your account landing page allowing comprehensive oversight.

Accessing Your Portal

First things first – let’s discuss how to access this powerful portal to unlock tremendous utility coordinating your milestone account.

Credentials For Entry

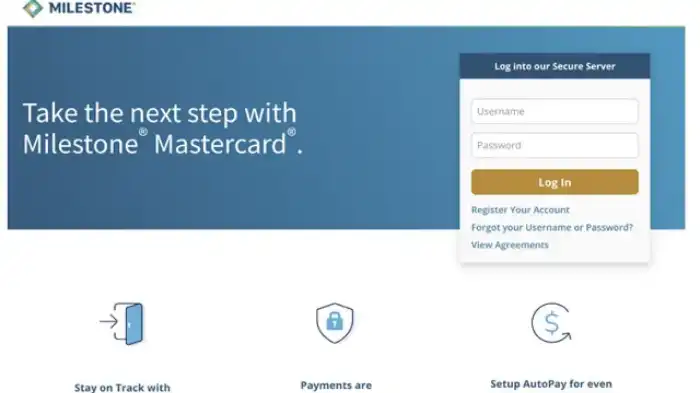

To access the portal, visit MyMilestoneCard.com and click “Log In” in top right corner.

On the login page, enter your unique login ID (typically an email address or username created during enrollment) along with the password associated with your account.

Be sure you have these credentials handy! Without them, you won’t be able to enter and leverage all the helpful homepage tools.

Multi-Factor Authentication

For added security validating identities beyond just usernames and passwords, multi-factor authentication is sometimes required when initially logging in from new devices.

This means entering one-time passcodes sent via email, text or automated voice call. So you may need access to email inboxes or mobile phones onhand the first time you enter the portal on any given device.

Verification only takes 30 seconds – well worth the fraud prevention peace of mind! going forward, passwords may suffice to streamline reentry.

Account Selection

Finally – if you have multiple Milestone accounts set up for several beneficiaries like children or grandchildren – you’ll need to use dropdown menus to specify the exact account you wish to access before entering the homepage dashboard unique to that account.

So in summary – have your credentials, devices and desired account ready for easy access into your customized portal!

Homepage Layout and Navigation

Once logged into your designated account successfully, let’s overview how the dashboard layout is structured along with core capabilities accessible through the portal.

Header Bar Navigation

Running across the top persistent banner, you have access to:

- Dropdowns to switch between accounts

- Links to check messages, access profile settings, or get support help

- Main menu showing pages like Transactions, Investments, Milestones

- Search box to instantly lookup transactions, documents and more

So the header bar allows swift access to account controls and priority pages.

Main Content Dashboard

Front-and-center on the homepage dashboard, core modules provide at-a-glance visibility into essentials like:

- Total account value chart showing growth over time

- Pie charts depicting investments, cash balances

- Lists of latest transactions and activities

- Status of milestones tracking towards specific goals

- One-click shortcuts to top tasks like funding account or contacting support

These windows aggregate vital snapshots so key info is visually summarized when you first land on the page.

Sidebar Links

Along both left and right sidebars, quick access links allow jumping deeper into specific account functionality like:

- Initiating one-time or recurring deposits & withdrawals

- Adjusting milestone goal allocation percentages

- Managing notification subscription preferences

- Downloading account documents or statements

- Contacting phone, chat or email support

The sidebars offer shortcut convenience to account controls without digging through submenus.

Now that you know your way around let’s explore key tasks facilitated through the portal.

Depositing Funds

Your homepage makes adding money into your Milestone account secure and simple – whether one-time or recurring.

One-Time Deposits

Click “Deposit Funds” in sidebar or “Move Money In” shortcut to:

- Enter dollar amount to transfer instantly from your linked bank account via ACH pull

- Or provide external bank details for money movement via ACH push

- Optionally designate specific milestones to fund or allocate across all

One-time deposits credit within 1-3 business days upon submission.

Recurring Deposits

Alternatively, build deposit schedules recurring automatically on weekly, bi-weekly, monthly or custom frequencies by:

- Again selecting money movement shortcuts from page

- Choosing “Make Recurring”

- Setting transfer details like start date, amount and cadence

Set-it and forget-it handsfree saving!

External Transfers

Besides online ACH capabilities, wire transfers or check payments can also fund accounts for families preferring those channels. Simply use sidebar links dispatching money instructions.

Funding feels frictionless through the optimized homepage.

Monitoring Balances

In addition to visible shortcuts adding money, central dashboard windows continuously track current balances across critical dimensions:

Total Account Value

The aggregated total account value chart plots complete current valuation combining:

- Cash balances held in secure online savings vehicles

- Invested assets actively working towards compound growth

- Any accumulated rewards or promotional incentives

Watch this top-line view rise over time!

Cash Balances

Underneath total value, allocated cash held across:

- Transactional accounts for withdrawals

- FDIC-insured accounts minimizing risk

Automatically shuffle aligning with spending needs.

Investment Balances

Next, investment portfolio balances breakout amounts actively invested across different:

- Age-based strategies like college or retirement goals

- Risk-based conservative/aggressive allocations

- Self-directed custom portfolios

Best part? All grow tax-deferred!

Balances always visible enabling instant financial awareness.

Customizing Milestones

Customizing the life milestones attached to your account is easily facilitated through the portal as well.

Adjusting Milestones

Click “Manage Milestones” sidebar shortcut to:

- Rename existing milestones if goals pivot

- Set new target dollar amounts if costs change

- Reallocate investment balances between milestones

- Change expected milestone timeline if years shift

Modify milestones over time as life evolves!

Recalibrate Investments

While adjusting milestones themselves, also reassess attached investment pools ensuring continued alignment with:

- Updated timeline ranges

- New milestone amounts if larger $$ now needed

- Beneficiary age shifts if accelerating or pushing out

Keep investments synchronized.

Contribution Allocation

Likewise, if modifying overall savings targets across milestones, revisit deposit allocation percentages spreading contributions appropriately towards refreshed goals.

Milestones stay adjustable as needs change.

Spending Funds

Naturally, after accumulating savings comes the satisfying ability to spend funds covering major milestone expenses in alignment with account intentions.

Everyday Spending

Tap into cash for qualified costs leveraging the:

- Physical milestone credit card providing authentication and fraud protection for in-person payments

- Digital card number allowing online checkout payments covered immediately after earnings accumulate

- Underlying bank account and routing numbers facilitating electronic payments

Use all 3 payment modes benefiting from enhanced security and convenience.

Cash Withdrawals

Withdraw physical currency as required through:

- 30,000+ surcharge-free ATMs nationwide when accessing cash

- Branch bankers at affiliated financial institutions

Either method provides fee-free access aligned with daily withdrawal velocity limits.

Transfer Money Out

Move money between Milestone account and your external accounts by:

- Logging into portal and submitting quick transfer requests

- Scheduling external recurring transfers

- Leveraging bill pay capabilities

Transfers routinely complete via ACH within 1-3 days.

So in summary – no shortage of seamless options tapping into savings when those pivotal life moments arrive!

Tracking Transactions

Whether depositing funds, investing, or spending – all types of transactions post into portal ledger windows for ongoing oversight.

Transaction History

Recent activities display right on central homepage with toggles sorting by:

- Deposits

- Withdrawals

- Recurring transactions

- Checks

- Miscellaneous

One-click dropdown details expense descriptions, amounts, statuses and more.

Search All Transactions

All history since account opening catalogs via sidebar search allowing custom filtering by:

- Date ranges

- Transaction types

- Keyword specifics within descriptions

- Source bank details

Export full transaction histories into handy spreadsheets if required.

Transaction Notifications

Beyond reporting, real-time alerts also trigger via email and mobile push keeping you in-the-know anytime:

- Deposits or withdrawals post

- Payments clear or are rejected

- Fraudulent activity suspected

- Unrecognized logins detected

So transaction awareness persists with running visibility.

Account Support Options

While the portal allows autonomous account management suitable for most needs, personalized support is also available through a variety of convenient channels.

Contact Center Team

Multi-channel customer experience squad offers assistance:

- By phone 24/7 for urgent needs

- Via email for detailed inquiries

- Through online chat for rapid insights

Agents help with topics like disputes, fraud, technical issues and general questions.

Secure Messaging

Ask basic questions or get help through two-way messaging via portal alerts inbox. Simply define subject line with issue and specialists respond directly often within just 1 hour during business hours.

FAQs

How do I access the MyMilestoneCard homepage?

To access the MyMilestoneCard homepage, simply visit the official website and log in using your username and password. Once logged in, you’ll be directed to your personalized dashboard.

What information can I find on the MyMilestoneCard homepage?

The MyMilestoneCard homepage provides a comprehensive overview of your account, including your current balance, available credit, payment due date, and recent transactions. It also offers options for making payments, reviewing transaction history, and updating account settings.

Can I make payments directly from the MyMilestoneCard homepage?

Yes, you can make payments towards your MyMilestoneCard account directly from the homepage. Simply navigate to the payment section and follow the prompts to initiate a payment using your preferred method.

How do I review my transaction history on the MyMilestoneCard homepage?

To review your transaction history, navigate to the transaction or account activity section on the homepage. From there, you can view a detailed list of your recent transactions, including the date, amount, and merchant information.

Conclusion

Navigating the MyMilestoneCard homepage is an essential step in effectively managing your credit account. With its user-friendly interface and comprehensive features, the homepage serves as a central hub for accessing critical account information, making payments, reviewing transactions, and exploring additional resources. By familiarizing yourself with the various sections and functionalities available, you can take control of your finances, stay informed about your credit status, and make informed decisions to achieve your financial goals.