Welcome to your comprehensive guide on how to enroll in MyMilestoneCard. We’ll walk you through all the nitty-gritty details you need to seamlessly set up your account and start saving for your child’s major milestones.

What is MyMilestoneCard, and How Does It Work?

MyMilestoneCard is a flexible savings and investment account designed specifically to help families save for a child’s future education, first car, first home, wedding, and other big life events. Here is a detailed overview:

Purpose

The card provides a tax-smart way for parents, grandparents, friends to contribute to milestones like:

- College tuition and expenses

- First vehicle purchase

- Downpayment on a first home

- Wedding costs

- Medical expenses

- Study abroad opportunities

- Startup capital for a business

- Mission trips and volunteer programs

Functionality

It works similarly to a prepaid debit card but with more flexibility and control:

- You open an account online with child’s info and milestone goals

- Fund it anytime from your bank account via ACH transfers

- Invest amounts in professionally managed investment pools

- Watch balances grow tax-deferred over time

- Access money tax-free as child approaches designated milestones

Convenience

Key features that make the program so convenient include:

- Easy online account opening and funding transfers

- Mobile app with dashboard to view balances

- Ability to re-allocate funds between different milestones

- No monthly statements (go paperless)

- Family & friends can contribute directly to account

- Low investment expense ratios (0.15% – 0.35%)

Now that you understand the purpose and functionality of the card, let’s get into the specifics on how you enroll step-by-step.

Enrollment Eligibility Requirements

Before going through the enrollment process, make sure you meet the eligibility criteria:

- Valid Social Security Number

- At least 18 years old

- U.S. citizen or legal permanent resident

The person enrolling the child, known as the Account Owner, does not need to be related but is responsible for managing the account.

Detailed Step-by-Step Enrollment Walkthrough

Ready to open your account? Follow along carefully with each step below:

Step 1: Prepare Required Information

Have the following information close at hand for both you and the child beneficiary before starting:

- Your full legal name and contact info:

- First and last name

- Physical residential address

- Email address

- Primary phone number

- Date of birth

- Social Security Number

- Child beneficiary’s full legal name and info:

- First and last name

- Complete residential address

- Email address (if applicable)

- Date of birth

- Social Security Number

- Initial bank account funding info:

- Account type (checking or savings)

- Routing number

- Account number

Note: You can save application as draft & come back to add more info later if needed.

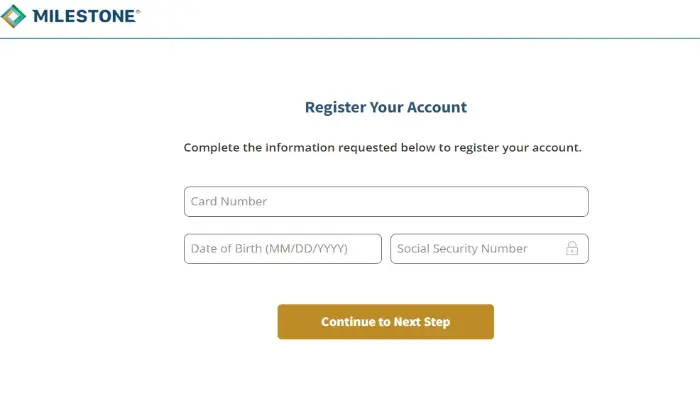

Step 2: Create Online Account Access

Go to MyMilestoneCard.com and click “Enroll Now” in the upper right corner. You will be walked through the process to establish login credentials for your account, including:

- Creating username

- Password requirements (minimum 8 characters including 1 uppercase letter, 1 special character)

- Establishing and answering security questions

- Agreeing to online terms and conditions

Make note of your unique username and password, as these will be needed whenever you log in to access your account.

Step 3: Complete Enrollment Form

With your account created, it’s now time to provide all the detailed personal information gathered in Step 1 to officially enroll:

- Enter your full legal name, physical address, DOB, SSN to verify identity

- Provide the same information for the child beneficiary

- Indicate your relationship to the beneficiary (parent, grandparent etc)

- Select types of milestones you want to save towards like college, home, wedding, etc.

- Provide bank account and routing number that will fund account

Double and triple check that all data entered is completely accurate to prevent any delays approving account.

Step 4: Make Initial Contribution

Once all information is submitted, make your first deposit into the account. You can contribute any amount, there are no minimums required. Most families start by funding with at least $250 – 500. Choose what works for your budget!

Step 5: Customize Milestone Goals

One of the great features of MyMilestoneCard is you can tailor it directly to your family’s personal goals and values. Take some time determining:

- Specific target amount needed for each milestone

- Years in the future milestones are expected (child’s college, wedding, etc)

- How recurring deposits should be allocated between milestones

Go back anytime to modify milestones as needed. Life changes, your account can too!

Step 6: Begin Saving & Investing

Now comes the rewarding part – watching your contributions grow!

- Set up automatic transfers from your bank into your Milestone account so it builds up effortlessly over time

- Have friends & family add money to the account as well for birthdays/holidays

- Select customized investment pools aligned with expected milestone timelines to optimize growth

- Check your account via mobile app anytime for easy access on the go

And you’re all done – that completes enrollment!

Next Steps After You Enroll

Here’s a high-level overview of recommended steps once your account is opened:

- Understand all the capable features of your online account portal and mobile app with how-to guides

- Set up regular automated funding contributions that align with your budget

- Determine an investment allocation approach between the available fund choices

- Invite family and friends to also save into the account via gift money

- Contact our helpful support team with any questions along the way!

We look forward to this being the start of a long-term pa

Responses to Common Enrollment Questions

We get a lot of questions from parents during the enrollment process. Here are detailed responses to some frequent ones:

Who is eligible to enroll a child?

While a parent typically sets up the account, it is available more broadly to any qualifying adult caretaker in a child’s life who wants to contribute funds including:

Grandparents

Godparents

Aunts/uncles

Older siblings

Family friends

As long as you are over 18, hold a SSN, and are a U.S. citizen or permanent resident, you can enroll as the Account Owner.

What ages can you enroll a child?

One of the great benefits of MyMilestoneCard is that you can enroll a child at any age – from newborn to teenager. However, it makes sense to enroll as early as possible to maximize tax-deferred investment growth potential over time.

Most parents open accounts shortly after birth, while some wait until middle school graduation. Ultimately you can decide what age makes most sense based on your family’s personal situation and goals.

How do I add additional money after initial funding?

It’s easy – simply log into your online account or mobile app and initiate a one-time or recurring electronic transfer from an eligible bank account under your ownership. Wire transfers are also accepted.

Or if you prefer checks, mail it along with contribution instructions. Be sure to include the account number and child’s name either in memo or letter to ensure it gets properly credited.

And don’t forget – friends and family can contribute money directly any time as well via gift deposits.

What fees are charged?

Good news – there are no account maintenance fees or charges to enroll. The only fees you pay are underlying investment management fees based on assets under management. These are typically 0.15% – 0.35% annually depending on which investment pools are selected.

Conclusion

Enrolling in MyMilestoneCard is a straightforward process, made easier with this detailed step-by-step guide. By following the instructions provided, individuals can navigate through the enrollment process with confidence and ease.

From accessing the enrollment portal to submitting personal information and creating login credentials, each step is carefully outlined to ensure a seamless experience. By completing the enrollment process, users gain access to a range of valuable features and services, including account management tools, payment options, and account monitoring capabilities.

Whether you’re a new cardholder or looking to maximize the benefits of your MyMilestoneCard, enrollment is the first step toward unlocking the full potential of your account. By taking advantage of this guide, individuals can embark on their journey with MyMilestoneCard with clarity and assurance.

Enroll today and take control of your financial future with MyMilestoneCard.